Is your vacation home generating more stress than income?

Swap your home for shares of the Overmoon 721 Fund to defer taxes, receive distributions, and maintain appreciation potential.

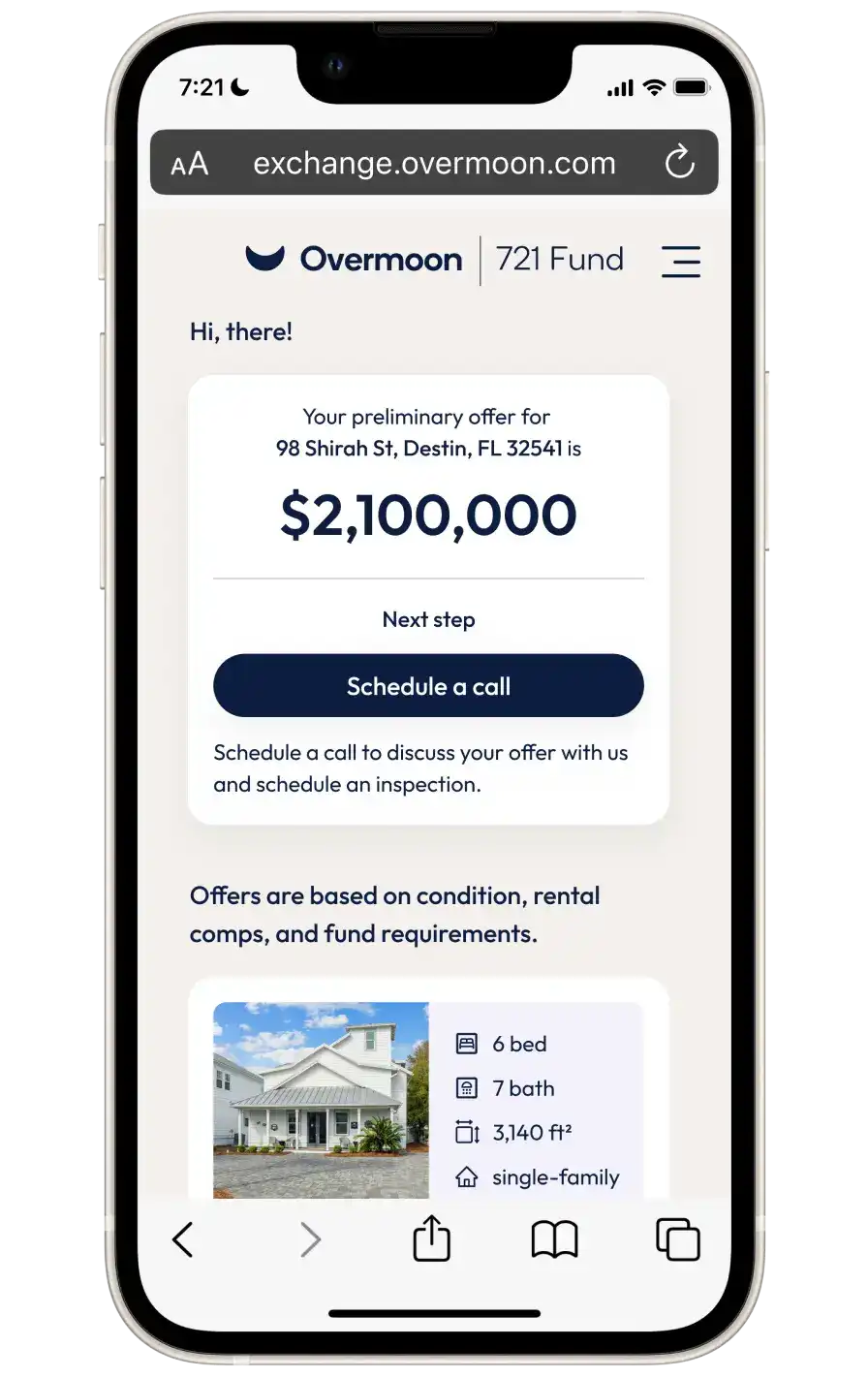

Seamless exchange and hand-off.

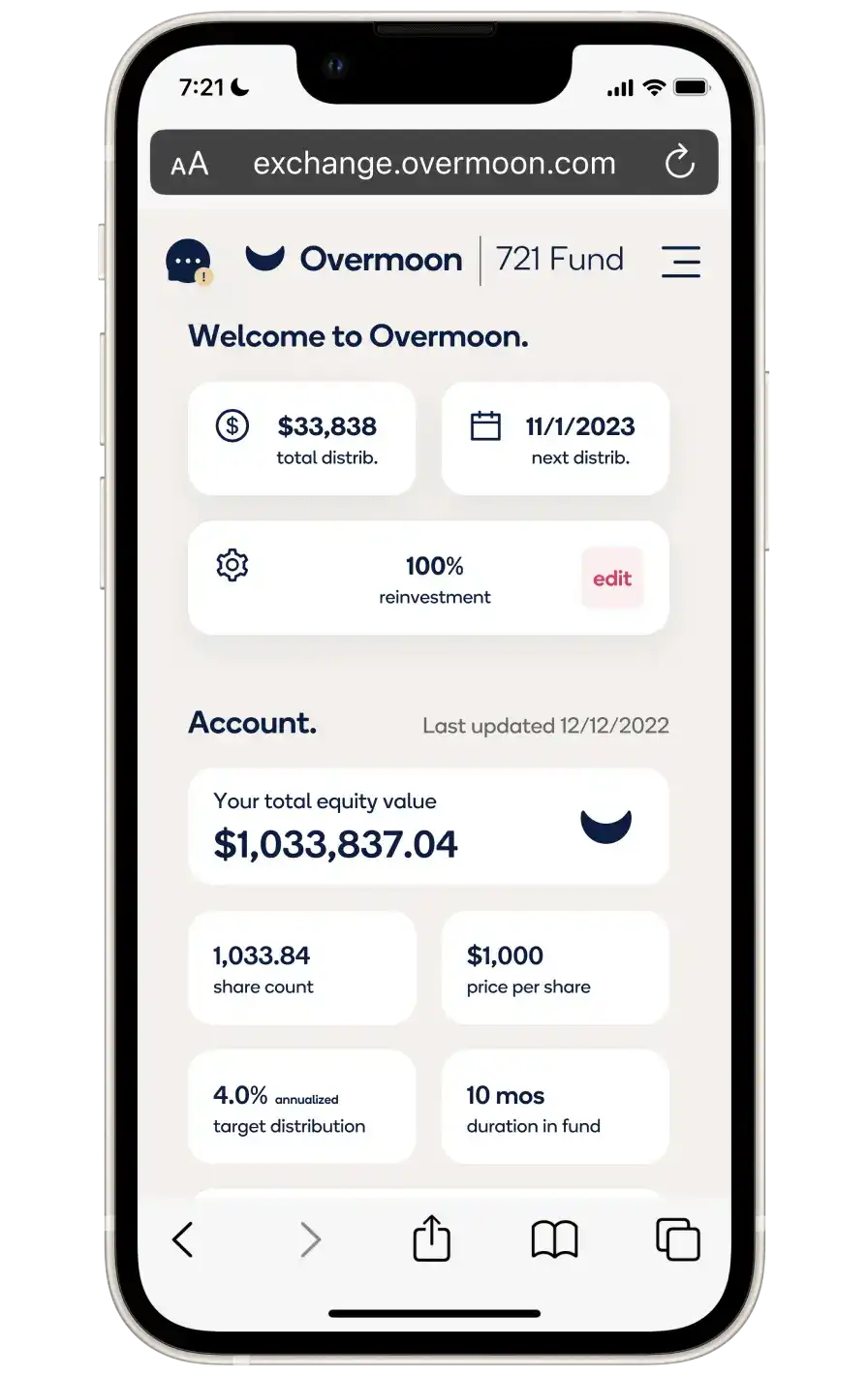

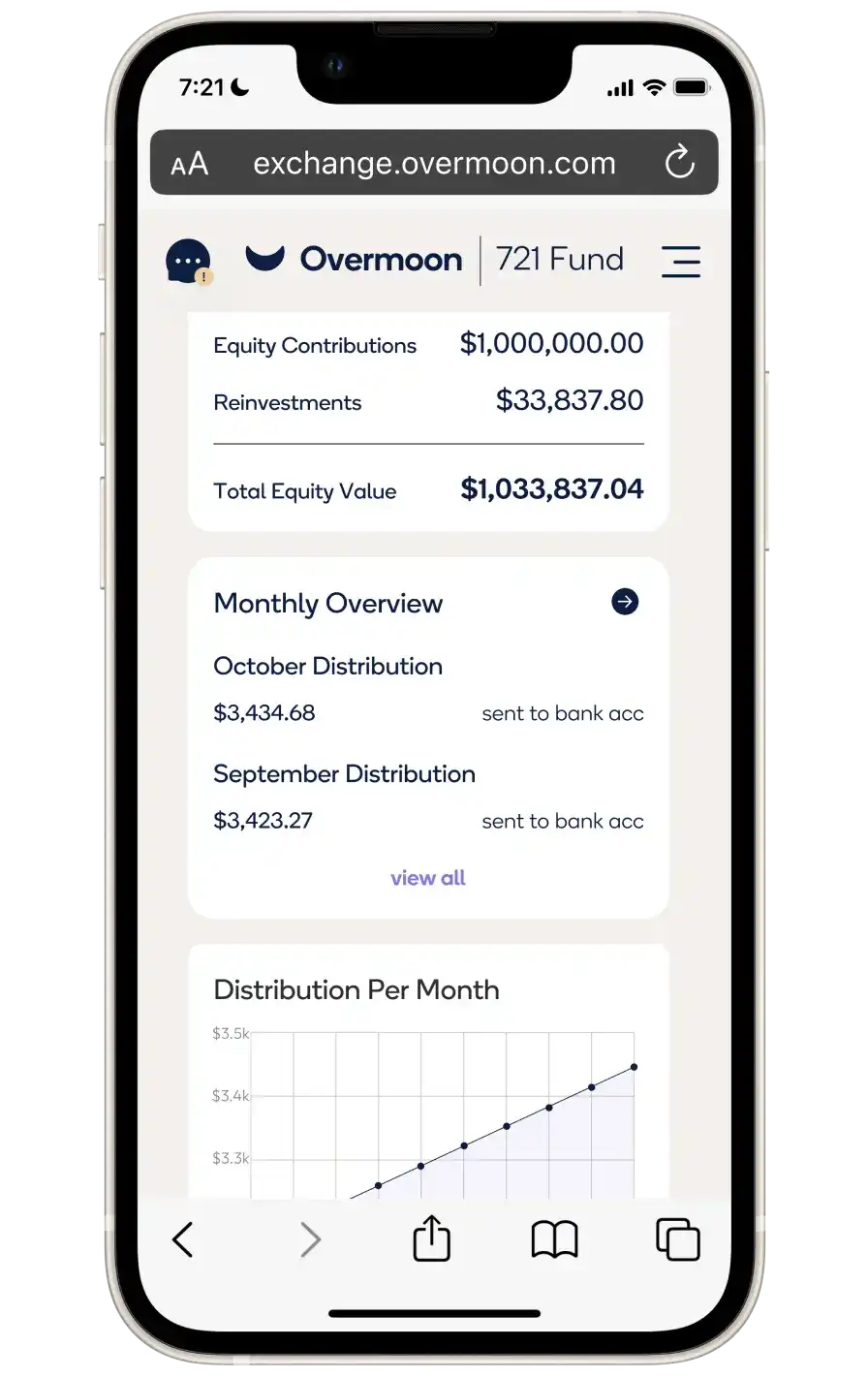

We’ll guide you through every step of the process. In as little as two weeks, title is transferred and we assume or payoff any financing associated with the property. Afterwards, you’ll receive shares in Overmoon ’s portfolio of homes equal to your remaining home equity value. We take over all aspects of maintenance and property management.Reliable income and potential upside.

The Fund intends to pay distributions via direct deposit, and you'll have anytime access to your owner’s portal to view notifications, performance, and important tax documents.Access liquidity.

The Overmoon 721 Fund was built to be your long-term partner, and we're grateful to protect your investment for years to come. That said, we offer access to liquidity. After three years in the Overmoon 721 Fund, you can participate in the share redemption program. Alternatively, your estate plan may have the ability to direct shares to your heirs.* Important Notices The information provided herein is for informational purposes only and for persons who qualify as accredited investors. It should not be interpreted as professional financial, tax or investment advice. The information provided herein is intentionally general in nature. It is important not to solely rely on this information when making investment decisions. Overmoon cannot guarantee the accuracy, completeness, or reliability of any information presented here. Private securities transactions involve a high level of risk and are not be suitable for all investors. These investments are illiquid, may require a long holding period, and could result in the loss of the invested principal. There can be no guarantee that investors will receive distributions or recognize their desired tax or investment objectives. Projections and forward-looking statements are hypothetical and may not be realized. Persons interested in the Overmoon 721 Fund are urged to consult their own tax and financial advisors. Prior to making any investment decisions, prospective investors should thoroughly review all offering documents and carefully consider their individual circumstances and risk tolerance.

The homes depicted on this page are not owned by the Overmoon 721 Fund, but are representative of the types of homes to be acquired by the Overmoon 721 Fund.